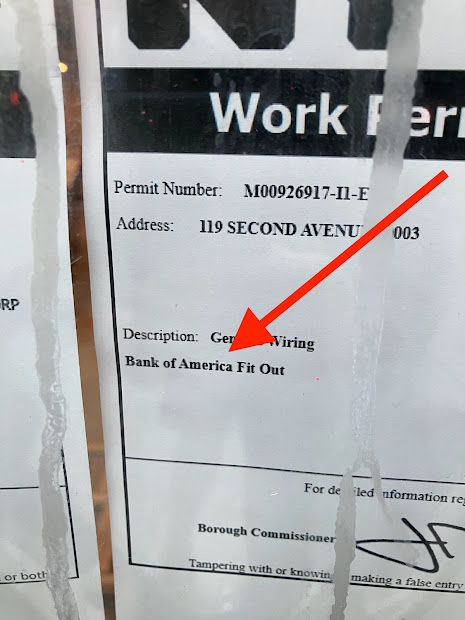

This branch arrival comes at a time when banks are reportedly closing neighborhood locations. (Plus, there's a BoA branch three blocks south on Second Avenue and Fourth Street.)

Figueroa, 23, who had recently graduated from SUNY Buffalo State, was at Sushi Park, 121 Second Ave. between Seventh Street and St. Mark's Place and the site of the fatal blast, dining with a co-worker. Locón, 27, worked at Sushi Park.

The explosion injured over 20 others and leveled 119, 121 and 123 Second Ave.

The previous corner building housed vintage shop Love Saves the Day for 43 years... closing in January 2009 after their rent was tripled. (Their location remains open in New Hope, Pa.)

17 comments:

not shocking--we all knew that when this building was built a bank would be the only one able to afford the rent

Banks are what we have for culture during this flavorless age.

At this point, as long it's rented, and it's not another smoke shop, that's a win.

Ugh

Of course it's a bank. Banks are the only ones that can afford that size of location with the equally large rent that's expected. It's never been occupied. It'd have been cool if they made that multiple smaller places that could help foster small businesses.... but nope, they don't care.

They didn't even clean it off weekly... they let people pay enormous amounts of money to live in that building without even cleaning the daily graffiti. They'd have happily allowed it to stay empty and collected the write-off.

Same deal with the new construction on 3rd ave on 10th st... No way someone is going to move into their giant retail space... It'll be as empty as the spot on A and 11th.

I was wondering if they'd ever really get a tenant for a space that big... Now to see if it lasts.

10:25am, while you may very well be correct about the types of tenants that can and can't afford the rent in that space, please don't perpetuate this ongoing myth of a phantom write-off for unoccupied commercial space. It comes up periodically in these comments, and it's just not factual. I can't speak to what that particular building owner wants or doesn't want, but I can speak to the fact that there is no mysterious "write-off" that benefits property owners who deliberately keep commercial space vacant.

Would love to see something other than a bank too, by the way.

If it had to be a bank I wish it had been a Chase. Closing the branch on 2nd and A made the closest branches (Bowery, Delancey, Astor Place) that annoying combination of absolutely close enough but just that tad bit too far to want to walk on a particularly lazy day.

OH YUCK - A BORING BANK! GRIM NEWS AS IT IS ON MY FREQUENT WALKING PATH. I HOPE THE LOCATION DOESN'T WORK FOR THEM AND THEY LEAVE ASAP.

No guarantee this bank will last any longer than any of the other retail shops that have closed. Don’t forget, Chase Bank that was located at the southeast corner of Saint Marks & 2nd avenue closed as soon as Icon Realty bought the property and hit them up for exorbitant rent.

i have heard that landlords keep the rent price crazy high, even at the risk of leaving space vacant in order to get better terms in with their bank (no pun/fun intended) anyone know??

The 4th street location will be shut. Apple just opened a brand new branch on 12th street and 4th avenue. The one on 2nd and 6th will be closing soon I would guess.

@4:39 I have heard they keep the listing rent high to show how much value their property is (potentially) worth, in order to borrow money on that asset, and others in their portfolio. So, sort of what you said. If the listing reflected the reality of supply and demand, their properties would be worth less on paper. There may be other downsides to that as well.

the 4th street location is an old school bank building, this will be 1/4 the size and 1/10 the charm. well, bars in old banks can be quite charming.

who are these people that go to physical bank branches in 2023? how can that make any financial sense?

Hi 4:39pm and 9:52pm. Regarding the question about whether landlords/owners keep their asking rent high to get better terms with their bank, or to show how much value their property is potentially worth, generally: no, that's not the case.

An asking rent or listing rent is simply that: an asking rent. It doesn't really influence the terms they get from their bank or the way a bank values the property. Banks and lenders aren't that ignorant, or else they wouldn't be in business very long! :)

Banks and other lenders do their own due diligence on what the market rent is for a particular commercial space by examining actual in-place rents at other similar commercial spaces in the area. They'll do this via their own methods - checking in place leases with other properties in their own lending portfolio, doing their own comparable research, etc. But they'll also always get a professional appraisal done by a third party before making any loan to a building owner. Those appraisals will contain a thorough analysis of what an actual achievable rent would be on that commercial space. Sometimes a bank/lender won't ascribe any value to the commercial space at all, without a signed lease in place, or at least a letter of intent from a potential tenant.

That's a long way of saying that artificially inflating an asking rent of a retail space isn't going to help an owner with loan terms or the value of their property. (Not that owners don't inflate the values of their properties on their financial statements - just look at the orange skinned scumbag on trial right now for evidence of that.)

So why do these spaces sit vacant so long? I'm not a property owner and I'm not an expert on this. My only input on that part is this: first, usually a retail lease isn't just one year (like an apartment lease usually is). It's usually a longer term, like 5 years, 10 years, even 15 years. So it might be worth it to an owner to hold out longer for a better deal from a tenant, especially during periods of temporary market changes and stuff. But usually it's probably just a matter of supply and demand. I dont know any other reason why spaces would sit vacant for so long, because it's definitely in the owner's best interests to find a tenant for their space - but I would think that they want to find a tenant that can pay the rent and stick around.

Do you never need cash for anything?

Post a Comment